Special Topics & Resources

Top 10 Reasons You Should Get a Will

Last Will and Testament

- You decide how your Estate will be distributed.

- You decide who will take care of your minor children.

- To avoid a lengthy probate process (it is easier AND faster for your Executor to distribute your assets to loved one).

- Minimize estate taxes.

- You decide who will wind up the affairs of your estate.

- You can disinherit individuals who would otherwise stand to inherit.

- You can make gifts and donations.

- Avoid greater legal challenges (which reduced the burden on loved ones who are already struggling with your death).

- Because you can change your mind if your life circumstances change.

- Because tomorrow is not promised; death is certain.

Living Will and Enduring Power of Attorney

There are other considerations, such as Living Will and Power of Attorney, that you should address when getting or updating your Will. What are your wishes if you are on life-support? Who do you want to manage your financial affairs if you are sick and unable to do so yourself? The Living Will makes your wishes known. The Power of Attorney is the person you have selected and trust to act on your behalf to make decisions based upon your wishes.

Why Should I Bother?

Does a Will Survive Marriage or Divorce?

A Will does not survive marriage. Your Will can become null and void if your Will was not written in contemplation of marriage. That means, if you marry, pre-marital assets may go to your new spouse if you die after marriage. That also means your children or other family members, for example, may not get assets that you intended for them.

A Will survives separation and divorce. That means, even if your assets are divided between you and your spouse following separation or divorce, your spouse may still inherit all or some of your assets if you do not have a Will or have not updated your Will to exclude him or her. In this particular case, you would need a legally binding Separation Agreement and updated Will to ensure your assets go to the people you designate and not to your spouse, if that is your wish.

Lawyer Referral for you Will

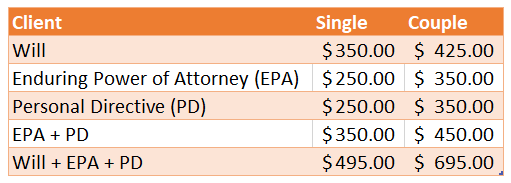

Need a referral for a Wills lawyer in Calgary? I recommend Brenda Tan-Uhuegbulem. She is in my building. She has very reasonable prices for Wills, Enduring Power of Attorney, and Personal Directive. If your ex-spouse used her services for review and signing of a Separation Agreement, she may not be appropriate to help you with your Will.

Instructions on Starting a Will Application

Should you wish to proceed to use Brenda’s services and you live in or near Calgary, please complete the following:

- Click here for your Will Questionnaire.

- Fill in the form (one for you and one for your spouse, if applicable) and save it to your desktop.

- Email the completed Will Questionnaire(s) to: brenda@btulawoffice.com

Brenda will telephone you and schedule an appointment for you (and your spouse, if applicable), to meet with her. Here rates are below.

Cohabitation Agreement or Pre-Marital Agreement

Are you living in a common-law relationship or are married? There is no guarantee that specific beneficiaries will be entitled to assets you or your spouse have willed to them if one of you has right to those assets as a result of your common law or marital relationship.

If you would like a consultation to learn more about getting a Cohabitation Agreement or Pre-Marital Agreement to protect particular assets in the event of separation, divorce or death, call Debbie Ward at 403-229-2774.

Organize Your Affairs

Step 1: Create a binder of all of your accounts, insurance policies and passwords.

Step 2: Keep your binder, all of your passwords and Will in a safety deposit box at your bank for safekeeping. Talk to your lawyer about when and how your Executor or Power of Attorney may access these accounts when needed.

Critical Illness and Guaranteed Income

It is one thing to be prepared for your death. But, what if you have a critical illness or injury and family members are tasked with getting you the best help and you have a limited budget?

Check with your employer to ensure you are protected in the event of illness or death. Some employee benefits plans include:

- an option for a lump sum payment to your beneficiary or estate in the event of death; and/or

- short or long-term disability (sometimes disability income starts right away or not until several weeks after the disability has occurred); and/or

- critical illness (you receive a lump sum payment if you are diagnosed with a serious illness).

Check with your employer if you can pay extra to top up your plan. You might be able to obtain extra insurance. You might be able to reduce the amount of time that you have to wait before disability income starts. Alternatively, some disability packages pay 50%, 60% or even 70% of your usual wages. If you feel your plan is inadequate, you can ask if you can increase your benefits at your expense. Sometimes you get better rates from group insurance plans than you would otherwise get on your own.

Alternatively, you may be able to talk to an insurance agent for additional benefits that will provide you with some protection in addition to your existing plan or if you lose your employment.

Also, check with your current plan administrator to see if you can continue your plan if your employment ends. If there is a disruption in your insurance, you may lose the right to have pre-existing medical conditions covered should you get re-insured elsewhere. The insurance company might allow you to continue your coverage uninterrupted, provided you continue to pay for the coverage.